Ein Augenzeuge der Schönheit

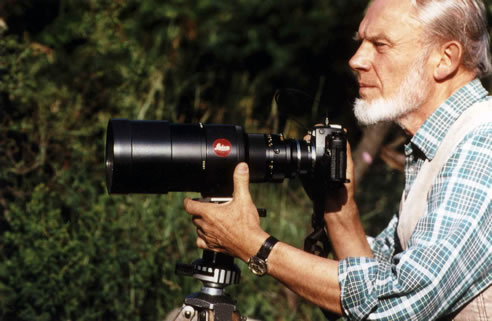

Natur- und Landschaftsfotograf Anton Kaiser

| Tauchen Sie ein in die Welt des Natur- und Landschaftsfotografen Anton Kaiser - vielen auch als der Rhönfotograf bekannt. Folgen Sie ihm auf die Kuppen der Rhön, lassen Sie sich faszinieren von windgepeitschten Bäumen, malerischen Wolkenbildern, verwunschenen Talauen und ausdrucksstarken Tierfotos. Diese Seiten geben Ihnen Einblicke in das über 50-jährige Schaffen des Fotokünstlers Anton Kaiser. Der bekannte Schriftsteller Peter Härtling nannte ihn einen "Augen-Zeugen", der die Schönheit, aber auch gleichzeitig die Verletzlichkeit der Rhönlandschaft zeigt. Viele seiner Natur- und Landschaftsaufnahmen wurden in internationalen Fotowettbewerben prämiert, er war der Bildautor zahlreicher Landschafts-Bildbände, davon zwei über die Rhön. Anton Kaiser ist am 7. Juli 2013 verstorben. Informieren Sie sich auf diesen Seiten über das Leben und Werk von Anton Kaiser.

Ein großer Erfolg war die Ausstellung zu seinem 90. Geburtstag vom 24. Juni bis 11. September 2016 auf dem Kreuzberg:

Rund 23.000 Besucher waren fasziniert von der Ausstellung "Der Fotograf Anton Kaiser - die Rhön mit seinen Augen":

|